Most of us understand the benefits of investing tax efficiently. Using the tax allowances, such as ISAs, provided by the government each year, means we can avoid paying unnecessary tax. However, many of us are missing out on the valuable tax savings available through our pensions.

Despite the revolution of the last six years, pensions are still one of the most tax efficient ways to save for your retirement. If you’re a UK taxpayer, in the 2022/23 tax year you can get tax relief on pension contributions of up to 100% of your earnings or a £40,000 annual allowance, whichever is lower. In simple terms, the tax relief you receive on pensions means some of your money that would have gone to the government as tax, goes into your pension instead.

You may be one of the thousands of people who have seen their savings grow over the last two years due to lockdown. A reduction in commuting costs, expenditure on entertainment and holidays has meant many people have found themselves with more disposable income. If you find yourself in this position, you could consider putting more into your pension. Even if you can’t commit to regularly saving more, you could consider investing additional lump sums. Redirecting any savings into your pension may mean you will be able to enjoy more of the good things in life, when the time comes to retire.

Alternatively, some of us have seen our income reduce during the last year which has affected our existing financial commitments. For example, having to reduce contributions to our pensions. If you are self-employed, your income will almost certainly vary from year to year, sometimes reducing the amounts you are able to contribute to your pension and your allowable tax reliefs.

Carry forward

However, whether you find yourself with more, or less to save, you can take advantage of any unused allowance from the previous three tax years, subject to allowances and limits. This is commonly referred to as ‘carry forward relief’.

Carry forward allows unused annual pension allowances from previous tax years to be carried forward and added to the annual allowance for the current tax year.

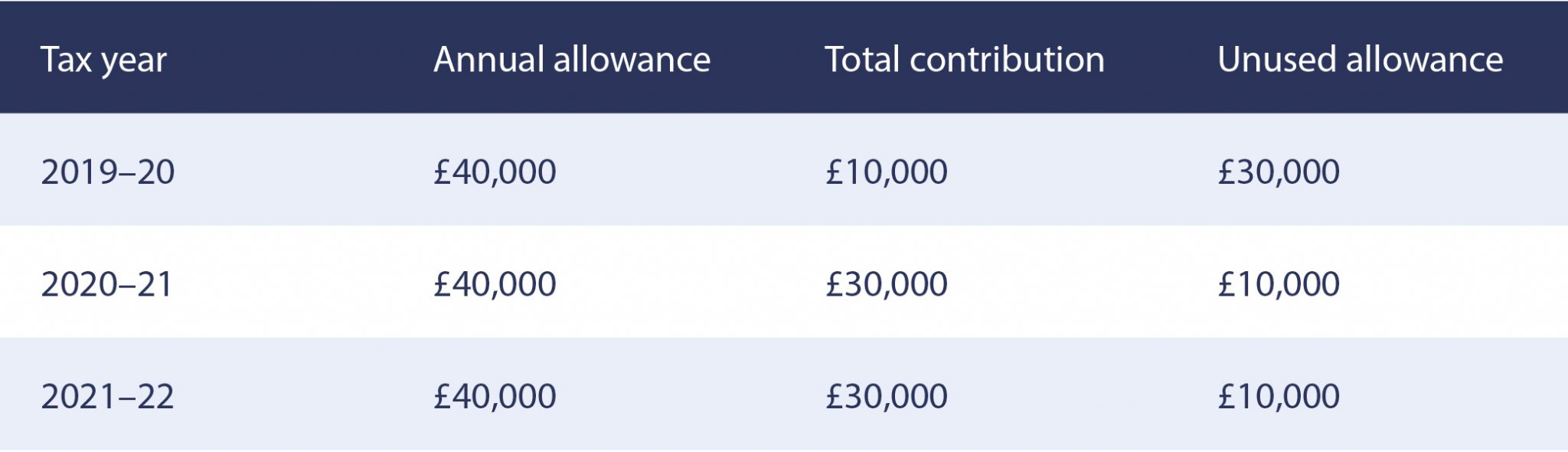

The example below shows how you could benefit. Considering the annual allowance of £40,000, there is £50,000 unused annual allowance from the previous three years. Added to the £40,000 annual allowance, £90,000 could be contributed to the pension and receive tax relief in the 2022/23 tax year. However, your earnings must be at least equal to the amount that you are looking to contribute at that point.

However, your earnings must be at least equal to the amount that you are looking to contribute at that point. So, in this example, to contribute £90,000, you would also have to earn at least that much in the current tax year.

Carry forward can be a valuable way of ensuring you don’t miss out and pay unnecessary tax. Whether that’s because you have additional savings to invest in your pension, or you need to temporarily reduce your financial commitments and would like to benefit in the future.

If you’d like to learn more, please get in touch now and stop paying tax unnecessarily.

Please note

Tax treatment varies according to individual circumstances and is subject to change.