Why is this?

The environment in which we make decisions effects our emotions and can influence the choices we make. Our emotions, not our practical reasoning often drive our choices.

We have evolved successfully as a species because we recognise perceived threats and react instinctively to avoid them. As hunter gatherers, that may have helped us to reach the top of the food chain, but it doesn’t always help us to make sound financial decisions in the 21st Century.

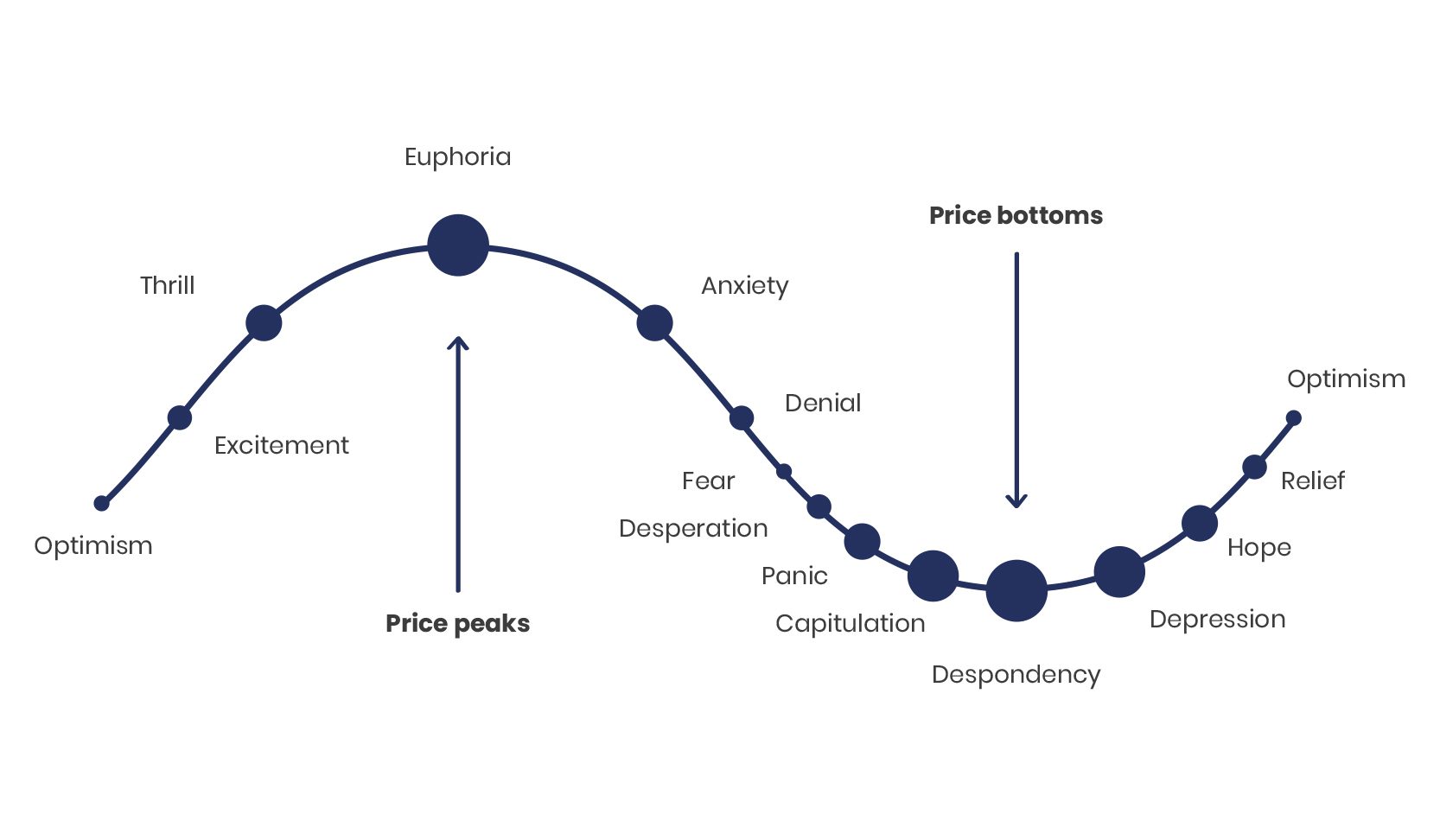

Behavioural journey graph

When markets are rising and the news is optimistic, we tend to be risk takers; when market are falling, and all seems doom and gloom we tend to be risk avoiders. This can result in investors buying only when prices are high and selling only when they are low – which is something our unemotional and considered selves will recognise as unwise, and a behaviour that our future selves may well come to regret.

This emotional response, where we sacrifice long-term goals for immediate emotional comfort can be highly detrimental to the performance of our investment portfolio and highlights the need to have a long-term investment plan to adhere to, regardless of our emotional ups and downs.

How we can help

We will work with you, using our investment expertise, to create an investment portfolio that is specific to your individual needs and financial objectives. By helping you establish a long-term financial strategy that reflects your need for emotional comfort, we will support you on your investment journey and help you avoid any potentially detrimental emotionally driven decisions.

The value of pensions and investments can fall as well as rise and you can get back less than you invested.