The current economic conditions present financial challenges. However, history shows that getting financial advice and investing with a long-term outlook is key to achieving your financial goals. Here is your three-step plan.

Step 1: Get financial advice

Speak to a financial adviser and get some expert advice. They can help to put your mind at ease about whether you’re doing the right thing. They can also help to take the emotion out of investing and provide an objective view. It may just be the best investment you ever make.

Step 2: Have a long-term financial plan

Your money needs to be in the right place to recover in value and make a profit if markets go up, so it’s important not to sell an investment as a knee-jerk reaction if its value goes down temporarily. It’s vital to make a long-term investment plan, stick to it, and don’t try to time the market.

Step 3: Make sure your investments are diversified

It’s best to invest in a range of different places where your money has a chance to grow. You should always hold some funds in cash in case of an emergency, but other investments offer better growth potential and by spreading money across different investment types, it is possible to avoid exposing your portfolio to undue risk.

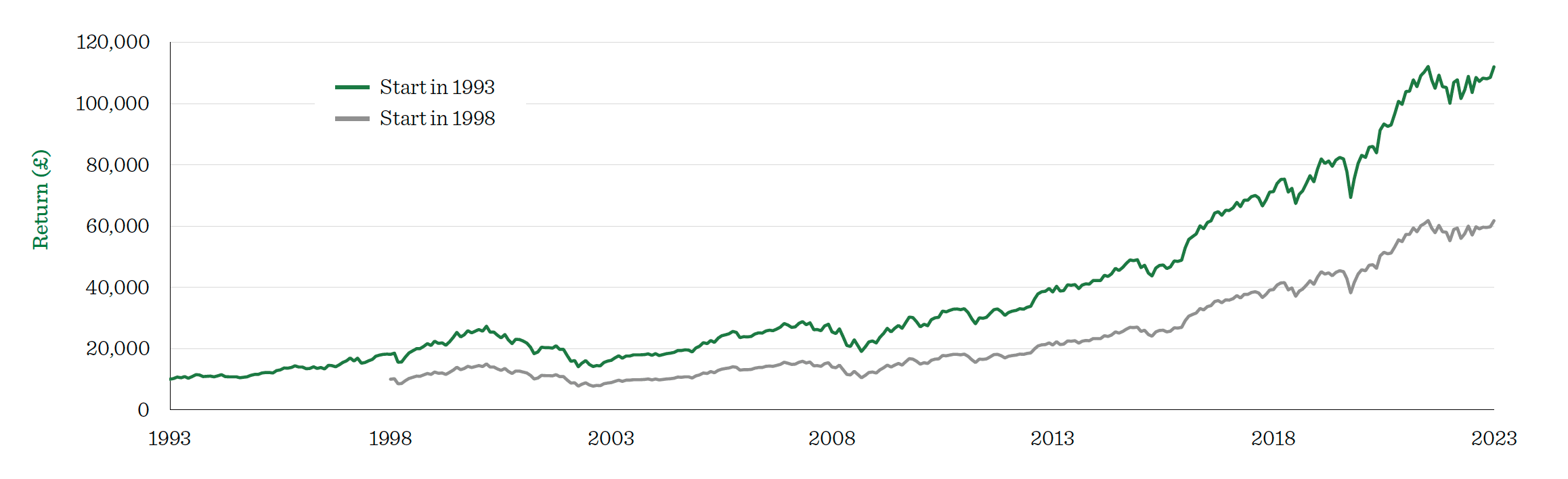

The advantages of investing early

Compound interest – earning interest on your interest – can have an incredible effect on your investments.

The chart below shows the benefits of investing as early as possible. An investor could have accumulated £50,264 more than someone who started investing five years later, even though they have both made the same £10,000 initial investment. If the other investor wanted to accumulate the same amount, they would need to make an investment of £18,147.

*Source 1

Key takeaways

- Invest as early and as soon as you can.

- Grow your investments quicker by earning interest on your interest.

- Avoid withdrawing money to boost the effects of compound interest.

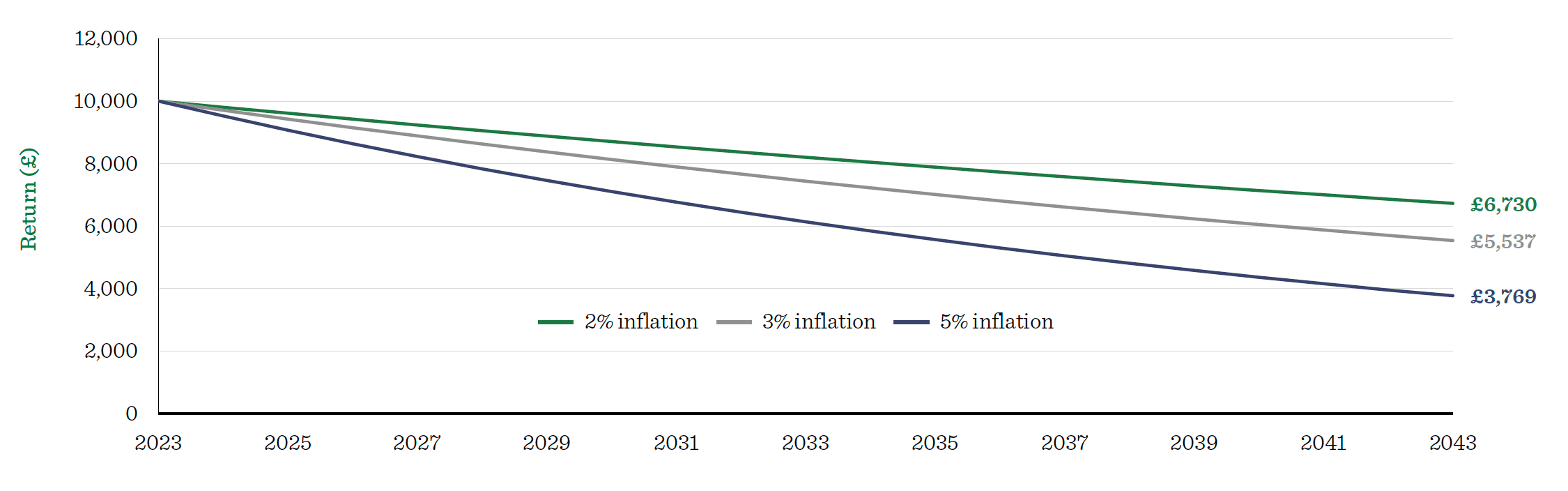

The dangers of inflation

It is tempting to see cash as a safe haven against market volatility, but inflation can be very damaging to your investments.

The chart below demonstrates how inflation of just three percent, well below the current levels, can reduce the value of cash by almost half over a twenty year period. Inflation can be incredibly corrosive to any savings held in cash.

*Source 2

Key takeaways

- Inflation can be devastating to your savings over the long term.

- Holding your investments in cash does not provide any protection against inflation.

- Cash should only be held for an emergency or for short- to medium-term income purposes.

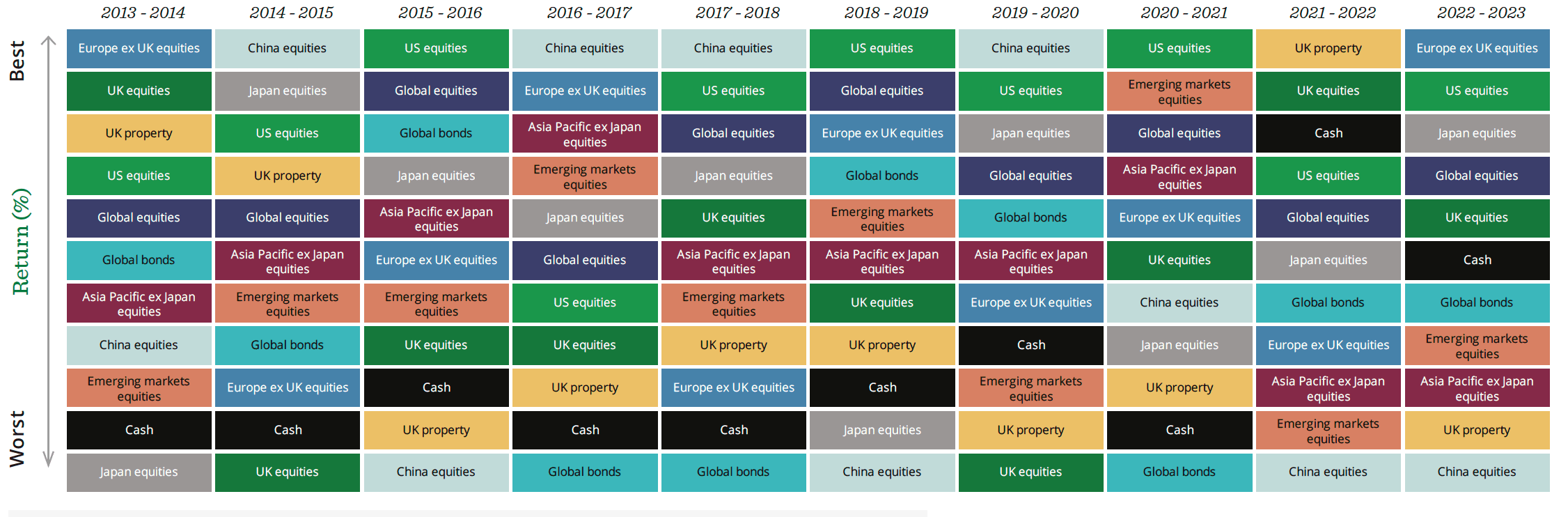

The benefits of diversification

By spreading your money across different types of assets, it is possible to avoid exposing your investments to undue risk.

The jumble of colours below – with each colour representing a different type of asset – shows how varied the performance of equities (company shares), bonds, and property has been over the past 10 years. There is no guarantee that the investment that is top in one year will perform well in the next.

*Source 3

Key takeaways

- Spread your money across a range of different investments to reduce risk.

- Don’t assume that the past performance of an investment will reflect its future performance.

- Investing in a range of assets is likely to be more successful than trying to pick just one or two.

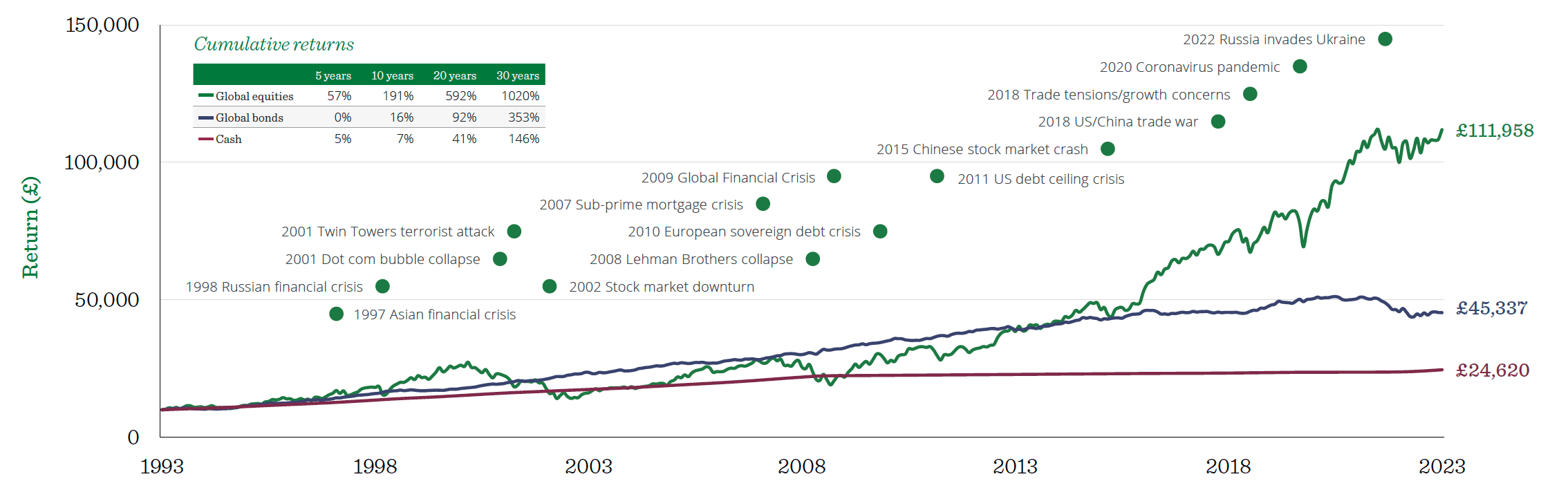

The importance of investing for the long term

Investing with a long-term outlook is the best way for you to reduce the impact of stock market fluctuations and to grow your investments over time.

The chart below shows that over the long term, there is an upward trend of returns from equities and bonds, despite the short-term volatility caused by major events. In fact, an investment into global equities could have grown by more than 1020% over the past 30 years.

*Source 4

Key takeaways

- Don’t let short-term blips distract you from your long-term plan.

- People who stay invested are more likely to see their investments recover.

- Investing over the longer term (five years or more) is more likely to be successful.

The reward of staying invested

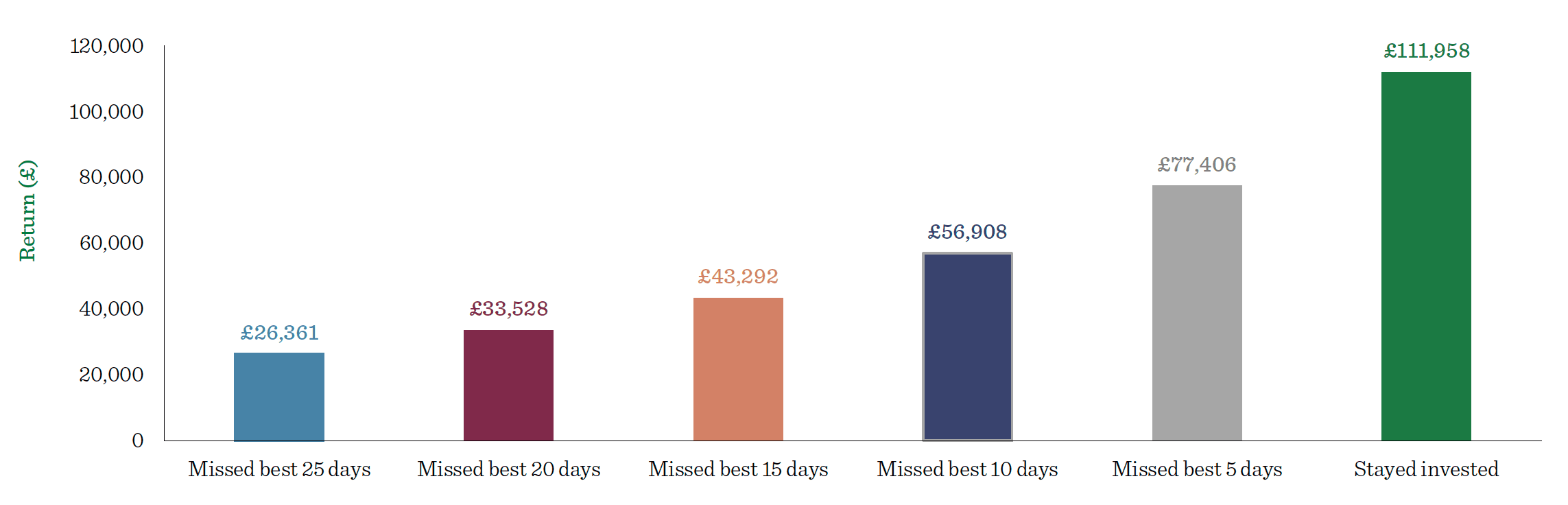

During periods of volatility it can be tempting to exit the market but missing just a few of the best days can have a big impact on your overall return.

The chart below shows that staying invested in global equities over the past thirty years, could have a delivered potential return more than four times greater than that of an investor who missed the best 25 days during the same period.

*Source 5

Key takeaways

- Time in the market is usually more successful than trying to time the market.

- Keeping your money invested means you can benefit from any upsides or bounces.

- Missing just a few good days can significantly reduce how much your investment grows.

Sources

*Source 1: Quilter Investors as at 30 June 2023. Total return in pounds sterling over period 30 June 1993 to 30 June 2023. Based on an initial investment of £10,000 into the MSCI All Country World Index. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

*Source 2: Quilter Investors as at 30 June 2023.The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment.

*Source 3: Quilter Investors as at 30 June 2023. Total return, percentage growth in pounds sterling. Discrete annual returns over period 1 July 2013 to 30 June 2023. Global bonds is represented by the Bloomberg Global Aggregate Index; UK equities is represented by the MSCI United Kingdom; UK property is represented by the IA UK Direct Property sector average; Global equities is represented by the MSCI All Country World Index; China equities is represented by the MSCI China Index; Emerging markets equities is represented by the MSCI EM (Emerging Markets) Index; Europe ex UK equities is represented by the MSCI Europe Ex UK Index; Japan equities is represented by the MSCI Japan Index; US equities is represented by the MSCI North America Index; Asia Pacific ex Japan equities is represented by the MSCI AC Asia Pacific Ex Japan Index; and Cash is represented by the Bank of England Base Rate. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

*Source 4: Quilter Investors as at 30 June 2023. Total return in pounds sterling over period 30 June 1993 to 30 June 2023. Based on an initial investment of £10,000. Global equities is represented by the MSCI All Country World Index; global bonds is represented by the Bloomberg Global Aggregate Index; and cash is represented by the Bank of England Base Rate. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

*Source 5: Quilter Investors as at 30 June 2023. Total return in pounds sterling over period 30 June 1993 to 30 June 2023. Based on initial investment of £10,000 into the MSCI All Country World Index. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

Please note

Past performance is not a guide to future performance and may not be repeated.

The value of investments and the income that they produce may go down as well as up. Investors may not get back the full amount that they originally invested.

Exchange rate changes may cause the value of overseas investments to rise or fall.

This communication is for information purposes only. Kind Wealth and Quilter Investors uses all reasonable skill and care in compiling the information in this communication and in ensuring its accuracy, but no assurances or warranties are given. You should not rely on the information in this communication in making investment decisions. Nothing in this communication constitutes advice or a personal recommendation.

Any opinions expressed in this document are subject to change without notice.

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited. 14/09/2023